C_NCENTRATE [FREE ISSUE]

IN THIS ISSUE: Airbnb's big new play, kill switches, AI beds, Netflix ads, CRISPR babies, wood stronger than steel... +++

NOTE: Moving to Beehiiv NEXT WEEK. Subscribe now before the price goes up when we move. A new look is coming…

THIS ISSUE IS FREE THANKS TO THE SMART COOKIES AT NOTION ↓

Thousands of startups use Notion as a connected workspace to create and share docs, take notes, manage projects, and organise knowledge—all in one place. We’re offering 6 months of new Plus plans, including unlimited Notion AI so you can try it all for free!

/// Play this ↓

Curated with neuroscientists, ’Focus’ is the official C_NCENTRATE playlist that aids your encoding and recall. Play as is, or hit shuffle.

/// Skim this ↓

OpenAI rolled out Codex, released GPT-4.1, and added Deep Research for Microsoft 365, while becoming the anchor tenant in a gigantic 5 GW UAE data centre. Anthropic secured a $2.5B credit line (pachiiiing!) and apologised after Claude hallucinated a citation.

Meta delayed its Behemoth LLM, lost key legal ground to Epic, and faced major datacenter criticism. Microsoft cut 6,000 staff while fending off an EU antitrust fine over Teams bundling. Google tested an AI Mode button, rebranded Find My Device to Find Hub, and extended Gemini to cars, TVs, and XR.

Amazon and Nvidia joined Saudi Arabia’s Humain in a $10B+ plan to build massive AI compute centres. Meanwhile, CoreWeave posted 420% revenue growth and landed a $4B OpenAI deal.

In policy, the US rescinded Biden’s AI export restrictions, scrapped CFPB rules on data brokers, and pushed the UAE to license Starlink. Japan legalized offensive cyber ops and the EU declared TikTok breached the DSA.

Apple denied blocking Fortnite, highlighted new accessibility features, and explored eye-control in visionOS 3. iPhone 16 faced heavy China discounts, while Tim Cook was told by Trump: “stop building in India”.

Elsewhere: Databricks bought Neon for $1B, eToro IPO’d at $5.4B valuation, Chime filed to go public, and Audible launched 100+ AI narrators. Klarna’s AI now handles 800 jobs’ worth of support chats.

/// Read these ↓

↑ Eight Sleep launched theAI-powered Pod 5 sleep system that automatically adjusts your bed's temperature and lift your head to prevent snoring. /4 mins

Gen X and Millennials aren’t ready for what long-term end of life care is going to cost them for parents. /7 mins

Here come the in-stream ads for Netlfix...and they’re generative. /4 mins

Chinese ‘kill switches’ have been found in US solar farms. /6 mins

↑ InventWood is about to mass-produce wood that’s stronger than steel. /4 mins

59% of Gen Z workers feel underutilised at work (and it’s causing a divide). /5 mins

Scientists used CRISPR tech to create a custom-made drug targeted at helping a newborn baby fight a rare genetic disorder. /6 mins + /6mins

AIRBNB WANTS TO BE EVERYTHING (AND NOTHING?)

$20 Airbnb is having a busy 2025, and no mistake. The company reported $2.27 billion in revenue for Q1, a 6% year-over-year increase that came alongside a softer-than-expected forecast for Q2, which pushed the stock down over 5%. But the numbers are not the story. They are a backdrop to a sweeping, expensive, and highly personal transformation being led by CEO Brian 'Founder Mode' Chesky.

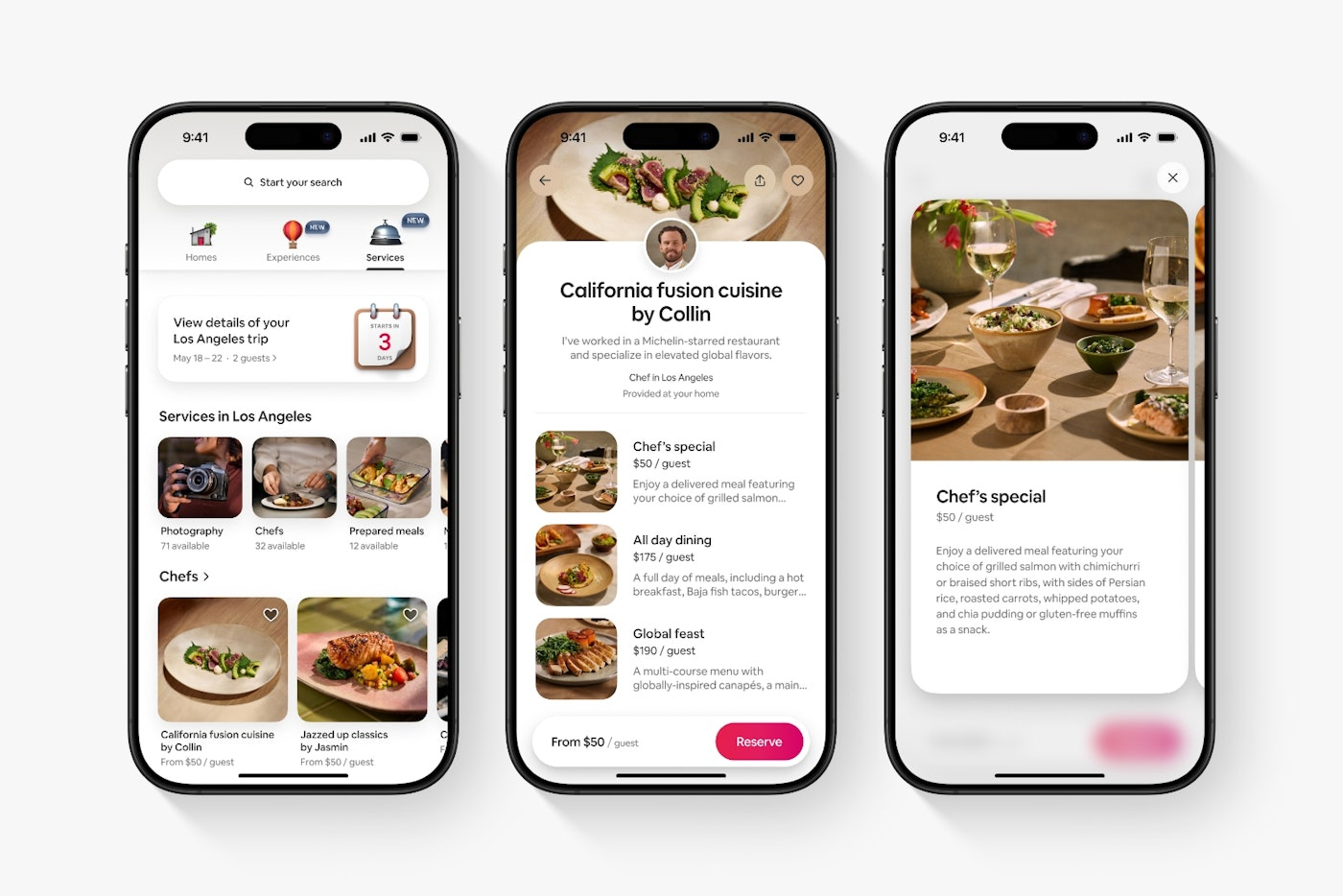

So what’s changing? Only everything. The recent relaunch of the Airbnb app marks the beginning of a new chapter. The platform, once narrowly focused on short-term rentals, now wants to be a daily-use product. The updated app introduces in-home services across 10 categories, including personal chefs, trainers, stylists, and massage therapists, available in over 260 cities. These services are bookable independently of a lodging reservation and include a wide range of entry price points, many starting below $50. Alongside this is a revamped version of Airbnb Experiences, now with nearly 20,000 curated events, tours, and workshops, designed to feel more premium and unique than the company’s earlier attempt at the format.

Chesky’s framing of the announcement is almost philosophical. In his words, Airbnb should be about connection in the real world, countering what he sees as the isolating effects of mainstream tech (ironic considering the issues Airbnb has around the world). Airbnb isn't just a travel company; it is, as he puts it, “a global community where you can live, travel, and belong anywhere.” Errr, perhaps.

Airbnb's move aligns with a long-running Silicon Valley ambition: the 'everything' app. In China, Tencent’s WeChat integrates messaging, payments, transportation, commerce, and more into a single mobile-first ecosystem. Grab in Southeast Asia offers ride-hailing, food delivery, payments, and even insurance. These platforms have succeeded not just through breadth of features but because of regional dynamics; users in Asia are more accustomed to closed platforms that combine many services and typically lack the privacy expectations or regulatory pressure seen in Europe or the US. The move is also a reaction to the incoming agentic AI travel guide wave that Airbnb is likely to be heavily impacted and disrupted by.

Replicating that model in the West is notoriously difficult. Meta has tried and failed to bolt commerce onto social platforms. Uber attempted bundling multiple services into a unified experience but found that users still prefer best-in-class apps for specific needs. Elon Musk has repeatedly declared that X will become a Western superapp but has yet to deliver a meaningful example of why users would choose it over the patchwork of apps they already use.

Airbnb believes its brand stands apart. With a reputation rooted in trust, hospitality, and community, Chesky is betting that Airbnb can occupy a unique position—one that lets it succeed where others have struggled. The company already verifies hosts, manages payments, and resolves disputes. The infrastructure for identity, safety, and transaction flows is already there. Chesky’s goal is to extend that to a wider set of real-world services, making Airbnb the interface not just for trips but for everyday moments.

The logic gets more complicated here as the core dynamic of Airbnb’s original business model depend on infrequent users on one side and regular supply on the other. Travellers need a place to stay once or twice a year. Hosts need to fill space as often as possible. Airbnb earns its fee by solving that mismatch. In the case of local services, the economics shift entirely. A user might book a haircut or massage once and then go direct. The service provider has no incentive to keep paying Airbnb’s fee if they can build an ongoing relationship outside the platform. Trust matters less, and repeat business becomes the goal. That dynamic does not align well with Airbnb’s transactional model.

SO WHAT?

Chesky has spent the last year in what he and others call “founder mode.” He has overseen every detail of the redesign, from icon styles to animation timing. He frequently references Steve Jobs and Walt Disney, calling himself a disciple rather than a peer, and has been deeply involved in crafting what he sees as Airbnb’s next identity. Design has always been central to Airbnb’s DNA, and the new app reflects that attention. The question is whether that level of control and polish can overcome the hard limits of marketplace economics.

Previous failures of Airbnb Experiences are instructive. Chesky believes the first iteration failed due to poor marketing and weak product execution. A more accurate reading might suggest that the economics were not viable at scale. Bespoke experiences require high effort and yield low margins. The only way to scale them without compromising quality is to raise prices significantly, which then limits demand. The result tends to be standardised products dressed up as local, personal encounters; precisely the kind of tourist fare Chesky wants to avoid.

Services may offer a better path. A chef or trainer brought into a holiday rental aligns with the kind of short-term, high-trust, one-off interaction that Airbnb handles well. For group trips and special occasions, having a curated and vetted list of local providers could enhance the core travel experience and increase transaction volume. The challenge will come if the company attempts to push this into everyday domestic use. Haircuts and spa treatments are regular, recurring needs. Platforms that succeed in this space build for repeat engagement and loyalty, not just discovery and first-time trust.

Identity is the most speculative piece of the plan. Chesky envisions Airbnb profiles as something akin to a passport; a persistent, verified, digital credential that can be used across services and even with governments. That aspiration raises deep questions about interoperability, regulation, and long-term platform control. Many have tried to own identity online. Facebook Login, Apple ID, and Google Accounts all attempted it. None has become a universal layer. The barriers are not just technical but political and cultural.

For all the vision and precision of the redesign, Airbnb’s success will not be decided by aesthetics. It will come down to whether the company can reshape user habits, build liquidity in new verticals, and create enough defensible value that providers and consumers both accept the platform tax. The presentation may evoke Apple. The business model is closer to Craigslist with a veneer of premium UX. Where does all this leave Airbnb? In an interesting place, certainly. In a risky place? Definitely.

DO Know that Airbnb are in a moment of high leverage and high risk. The company could become an essential tool for real-world coordination, or it could drift into product sprawl and margin dilution. History says the latter, but the AI element could be interesting if the cards are played well. Investors should focus less on the beauty of the new interface and more on adoption metrics outside travel. Will users book services without lodging? Will providers stay after the first few bookings? Will Airbnb be paid for those interactions? The transformation is underway. The market will decide if it is a reinvention...or a detour(!). The question is whether users will show up..

DON’T Ignore that Airbnb’s reinvention is bold, coherent, and entirely dependent on market behaviour it cannot directly control. The vision of a Western everything app is compelling, and Airbnb is among the few companies with the brand, user base, and infrastructure to try. At the same time, local services, identity layers, and personalised experiences are structurally different from the short-term rental market Airbnb already dominates.

THANKS AGAIN TO THE SMART COOKIES AT NOTION FOR MAKING THIS ISSUE FREE ↓

Thousands of startups use Notion as a connected workspace to create and share docs, take notes, manage projects, and organise knowledge—all in one place. We’re offering 6 months of new Plus plans, including unlimited Notion AI so you can try it all for free!