C_NCENTRATE [FREE ISSUE]

IN THIS ISSUE: Criminal microbes, robots, building a legacy, Apple's big Google love(?), concrete urine +++

NOTE: Moving to Beehiiv shortly. Subscribe now before the price goes up when we move. A new look is coming…

THIS ISSUE IS FREE THANKS TO THE SMART COOKIES AT NOTION ↓

Thousands of startups use Notion as a connected workspace to create and share docs, take notes, manage projects, and organise knowledge—all in one place. We’re offering 6 months of new Plus plans, including unlimited Notion AI so you can try it all for free!

/// Play this ↓

Curated with neuroscientists, ’Focus’ is the official C_NCENTRATE playlist that aids your encoding and recall. Play as is, or hit shuffle.

/// Skim this ↓

OpenAI had several major bits of news this week. Find out the full story in ‘What Did OpenAI Do This Week?’. Google too, including settling with Texas for $1.4B over privacy violations and paying $50M to resolve racial bias claims. Meta won $168M in damages from NSO Group over spyware attacks. Microsoft beat back the FTC's appeal on its $69B Activision deal. Apple faced fresh App Store pressure post-Epic ruling and appealed to pause court restrictions. Apple also earned $10.1B from U.S. App Store commissions in 2024, while developing smart glasses chips for 2027. Pinterest settled its creator lawsuit for +$37m.

The U.S. government sanctioned Myanmar-linked scam networks, halted supervision of Google Pay, and opened a probe into Trump’s crypto empire. Meanwhile, the White House reversed its AI chip export rule.

In other news, IBM used AI to replace 200+ HR staff and hired engineers. Nvidia launched an open-source transcription model. Anthropic added web search to Claude. Microsoft joined Google's A2A agent standard. Figma launched AI tools for apps and marketing, Netflix rolled out ChatGPT-powered search, and Stripe debuted a foundation model for payments. Databricks is in talks to buy Neon for ~$1B. Rippling raised $450M at $16.8B valuation. ServiceNow bought Data.World, and Shopify reported $2.36B in Q1 revenue, as Shein and Temu saw U.S. sales plunge.

/// Read these ↓

↑ Fancy a house made of urine concrete? /6 mins

New gene-editing trials are showing halting/reversing GI cancer. /7 mins

This solar farm installation robot does the work of '3 or 4' humans. /6 mins

How to build a legacy with small actions. /9 mins

Stratolaunch’s autonomous hypersonic plane just landed after reaching mach-5. /5 mins

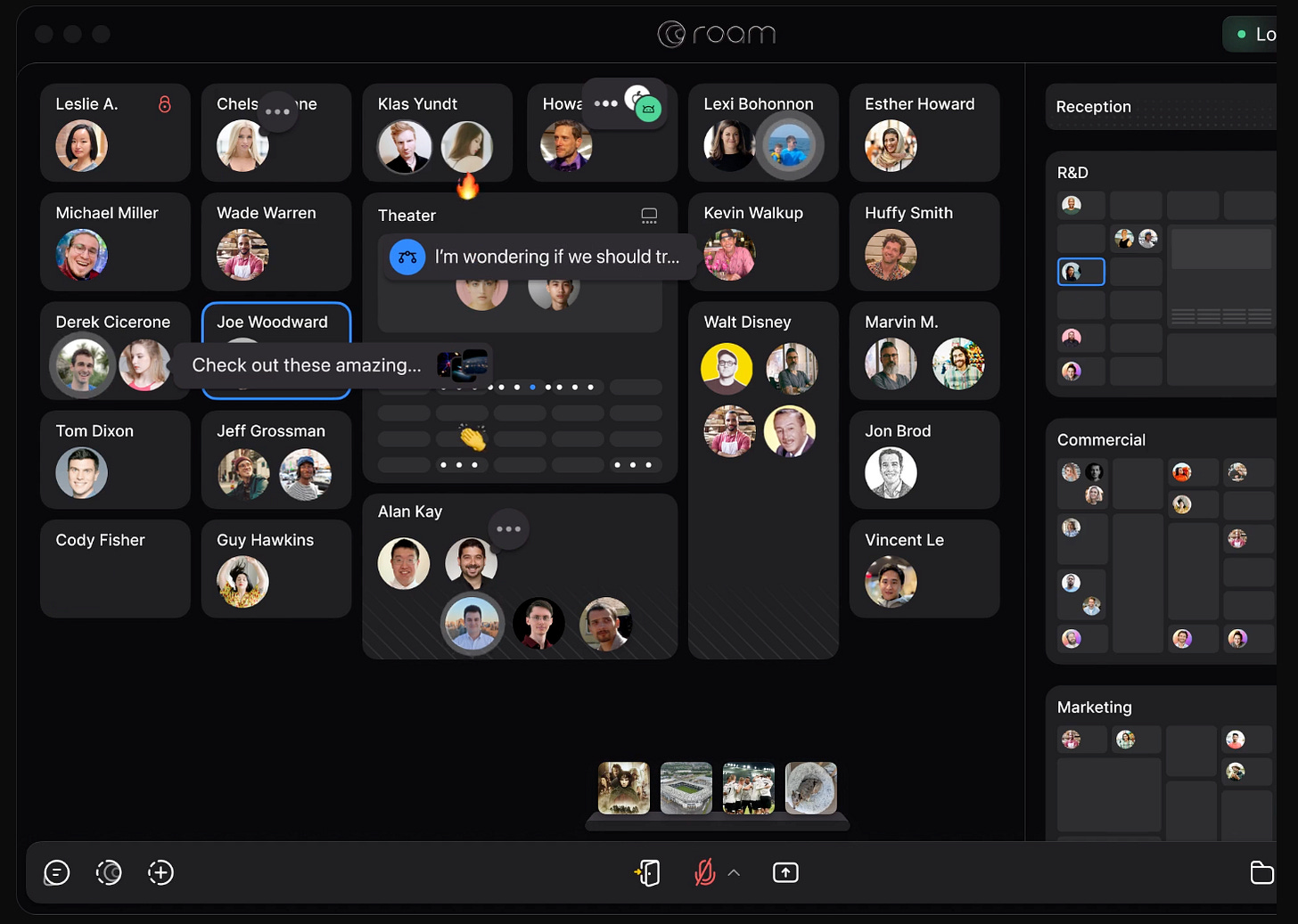

↑ Very interested in Ro.am, is it the office of the future? /2 mins

Despite several previous failures, Meta is starting to really cosy up to crypto after hiring Ginger Baker in January. /7 mins

Palantir is increasing the company to watch and not for good reasons. /9 mins

Why copyright alone cannot protect the future of creative work. /20 mins

How your gut microbes might encourage criminal behaviour. /18 mins

WHY APPLE WANTS TO SAVE GOOGLE

$20 billion smackers. The rough amount Google pays Apple annually to remain the default search engine on Safari (±1 billion users). As the Department of Justice challenges Google’s dominance in search, Apple has emerged as one of its key allies. Senior Apple executive Eddy Cue testified that Google faces real competition, is losing search share on Safari, and should not be penalised for being the default.

On the surface, this alliance looks unusual. Apple and Google are rivals across operating systems, devices, and increasingly AI. But beneath that, the two companies are commercially intertwined. The DOJ views their search agreement as a central piece of Google's strategy to lock out rivals and maintain market power. Apple, by contrast, portrays the deal as a benefit to users and a reflection of quality, not coercion. The broader case is not just about search dominance, it’s about whether dominant firms can use payments and preinstalled defaults to entrench their position and shut down competitors before they get traction. Apple’s support of Google, though framed around user experience, is fundamentally about preserving a high-margin revenue stream that underpins its growing Services business.

Regulators are pushing back against the argument that users can easily switch providers. The DOJ is positioning defaults as a structural advantage, not a matter of convenience. From their perspective, smaller search players cannot compete if they are never given visibility at scale. At stake is the core business model for both companies. Google’s search advertising empire relies on being the first stop for billions of queries. Apple’s Services growth relies on being paid to make that happen. Disrupting the deal would force both companies to rethink how they monetise attention and traffic across devices.

SO WHAT?

Apple’s courtroom defence of Google is not ideological, it’s financial and strategic. The search deal is too important to Apple’s bottom line, and the user experience too central to its brand, to risk a chaotic or degraded alternative. The DOJ’s case challenges a business structure that has defined digital platform growth for the past decade. If the government wins, the implications will ripple across browsers, voice assistants, app stores, and AI interfaces. Apple wants to preserve a controlled, polished user experience funded by strategic partnerships. Regulators want to introduce friction that creates space for new entrants. The outcome will help determine who controls the entry points to the internet in the AI era.

DO Watch how Apple distances itself in public messaging while fighting to protect private revenue structures.

DON’T Treat the defence of this arrangement as a temporary alignment. The two companies are more interdependent than they appear.

THANKS AGAIN TO THE SMART COOKIES AT NOTION FOR MAKING THIS ISSUE FREE ↓

Thousands of startups use Notion as a connected workspace to create and share docs, take notes, manage projects, and organise knowledge—all in one place. We’re offering 6 months of new Plus plans, including unlimited Notion AI so you can try it all for free!