C_NCENTRATE

IN THIS ISSUE: Mega AI roadmaps, introducing O°, work avatars, removable paint, phones transmitting smells, jobs, and more.

THIS ISSUE OF C_NCENTRATE IS SPONSORED BY:

TBD+ — the global intelligence collective that’s your gateway to exclusive events, a vast content repository, a powerful network, job opportunities, and more.

Explore what’s next: members.tbdpl.us.

/// Play this ↓

’Focus’ is the official C_NCENTRATE playlist curated with neuroscientists to aid your encoding and recall. Play as is, or hit shuffle.

/// Read these ↓

MUST READ: AI avatars are about to replace you in meetings. /6 mins

↑ Introducing O° – shoes and textiles designed to begin and end with biology. 100% biodegradable, no petrochemicals/microplastics/forever chemicals. /2 mins

Coke and Dr Pepper are outselling Big Macs and Starbucks right now but not for the reasons you might think. /6 mins

Why Meta and pals are (and will keep) filling their feeds with AI slop. /10 mins

Why can’t America (or anywhere) think long-term? /6 mins

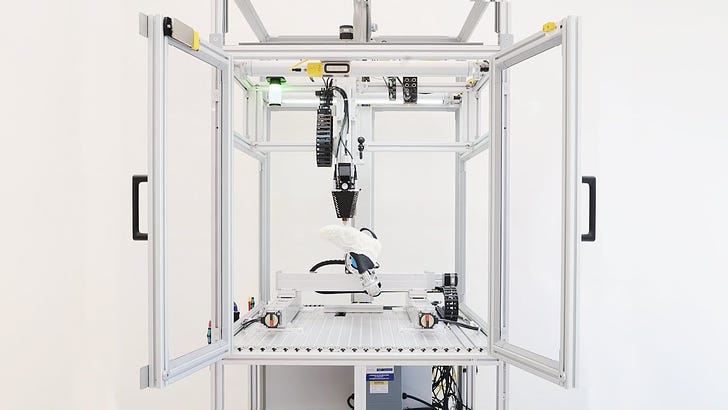

↑ The latest video from Boston Dynamics shows a less rosy future for unskilled/low-skilled job folks. /2 mins

Will phones someday be able to transmit smells? Scientists are working on it. /7 mins

A new startup, Frate, wants to facilitates direct exchanges between customers, are they about to fix the returns problem for retailers? /3 mins

Missed this. Removeable paint. /6 mins

Google has added Gemini AI to maps, and that might not be great... /4 mins

CONTROL-ALT-MONOPOLY? BIG TECH BUILDS THE BACKBONE FOR AN AI-DRIVEN FUTURE

Head over to ‘What Did OpenAI Do This Week?’ for the deep dive on all the ramifications of OpenAI launching SearchGPT, but here in C_NCENTRATEville we’re talking mega earnings and AI expansion.

Big Tech’s Q3 earnings were bumper and highlight their readiness for an all-out AI and infrastructure expansion war. First, the numbers: Apple reported $94.9 billion in revenue and $14.7 billion in profit (which would have been higher if not for a hefty one-time $10.2 billion tax charge!), underscoring the financial stability behind its aggressive moves into satellite technology. Amazon’s AWS continued its climb with Q3 growth reflecting increased demand for cloud services as the backbone for AI workloads. Similarly, Meta reported Q3 earnings of $34.1 billion, with ad revenue rising 6% year-over-year, while Alphabet posted $76.9 billion in revenue, fuelled by an 11% increase in ad revenue. These robust figures put both companies in a strong position to direct substantial funds toward infrastructure and AI development.

Such financial strength fuels a larger strategy: these companies aren’t just investing in AI applications; they’re building proprietary ecosystems to control the connectivity and data pipelines AI relies on. Apple’s up to $1.5 billion stake in Globalstar reflects this shift, securing satellite-based connectivity for its devices and expanding its ability to offer network-independent services. For Apple, this investment aligns with a broader vision of autonomy across its ecosystem, from hardware to services, giving it a competitive edge in device connectivity even in remote regions.

Amazon’s ongoing AWS expansion points to a similar vision, with cloud infrastructure serving as the unsung hero in supporting data-intensive AI applications. AWS is indispensable to enterprises that rely on scalable, on-demand computing power, making Amazon’s cloud dominance a linchpin in the digital economy. Meta, meanwhile, is branching out from pure software into robotics, investing in tactile sensors (DIGIT/ReSkin) that will help healthcare and manufacturing by integrating AI into physical interactions.

But as Big Tech fortifies its position, regulatory and ethical challenges are coming. Anthropic wants better regulation (mainly so it doesn’t get squashed), while OpenAI’s entry into search with ChatGPT also raises competition and misinformation concerns, indicating that Big Tech’s reach may soon extend into domains traditionally controlled by established players like Google.

The global implications of this race became starkly apparent with China’s recent adaptation of Meta’s Llama 2 model for military purposes, spotlighting the dual-use risks of open AI models. For companies like Meta, whose models can be repurposed in unexpected ways, the stakes of controlling AI infrastructure are higher than ever, especially amid rising geopolitical tensions.

As these power plays unfold, the infrastructure race signals a future where control over AI is as much about the technology itself as it is about the physical and digital infrastructure that supports it. With their Q3 earnings as a financial buffer, Big Tech is rapidly moving to consolidate this control, shaping the trajectory of AI on a global scale.

SO WHAT?

For businesses and innovators, the stakes are clear: without significant resources, competing in this new AI landscape is becoming nearly impossible. As Big Tech firms tighten their grip on foundational infrastructure, smaller players will either have to find niche opportunities or risk dependency on the very companies they’re trying to disrupt. The decisions made today will set the stage for a future where the boundaries of AI are not merely technical but are dictated by who controls the infrastructure beneath it.

DO: KNOW YOU DATA RIGHTS. Understand the data policies of AI providers, particularly around ownership and usage. Big Tech’s infrastructure expansions mean more data integration, so clarify how your data is handled to ensure it aligns with your privacy expectations. Not easy, but important.

DON’T: IGNORE VENDOR LOCK-IN. Relying on a single (big) tech provider can limit flexibility and drive up costs long-term. Review contracts and be mindful of lock-in risks to keep options open with multi-cloud or hybrid approaches.

/// Bookmark these ↓

- The Gradient (Stanford) - accessible research summaries

- Internet Health Report (Mozilla) - How healthy the digital landscape is.

- AI Toolkit (WEF) - How AI is shaping industries, jobs, and governance.

- AI Policy (EU) - Regulatory stance, frameworks, etc.

/// Answer this ↓

LAST WEEK’S RESULTS:

Q: “In your opinion, what will AI most profoundly disrupt?”

A: The global economy per 100% of you. Yowzas.

/// Apply for these ↓

Data Scientist, Healthcare, UnitedHealth Group (New York, US/$120k–$150k)

Content House Producer, Procter & Gamble (Cincinnati, US, UK/$85-115k)

Sr. Director, PR & Partnerships, Canada Goose (London, UK/£80k)

Internal Communications, Go to Market, Stripe (Dublin, Ireland/$150-225k)